Earn More Without Burning the Midnight Oil

In the high-stakes domain of finance, the notion that extended work hours lead to increased earnings remains prevalent—however, the most successful individuals understand differently. Genuine financial advancement is found not in extended hours, but in maximizing assets, exploiting market discrepancies, and harmonizing tactics with passive and semi-passive avenues. For those already possessing wealth, liberating oneself from the time-income dilemma requires smarter work, rather than harder efforts, to unveil income avenues that prosper without continuous oversight.

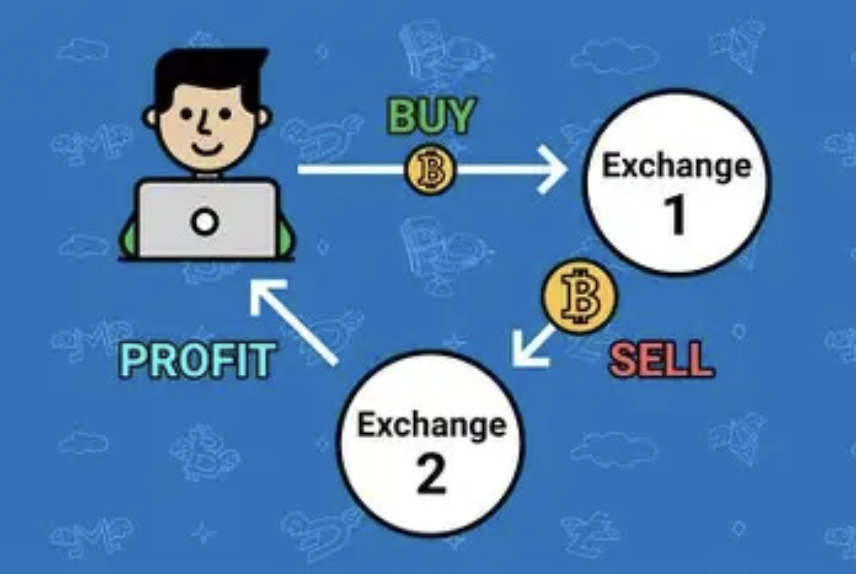

Asset Arbitrage: Profits Without Time Constraints

Astute investors take advantage of asset misalignments instead of investing additional hours. This includes reallocating underperforming investments—like dormant real estate or low-return bonds—into different assets such as private credit funds or fractional stakes in specialized businesses. The profits arise from strategic changes, not from labor, transforming stagnant capital into reliable income with little ongoing effort.

Financial know-how is intrinsically a timeless asset. Rather than exchanging hours for compensation, experienced experts bundle their knowledge into subscription-based advisory services, tailored investment newsletters, or exclusive mastermind groups. This framework converts one-off consultations into continuous income, allowing expertise to produce earnings while prioritizing significant decisions over repetitive tasks.

Maximizing Dividend Reinvestment

Dividends are frequently ignored as a source of passive income, but thoughtful reinvestment boosts returns without added workload. Instead of cashing in on distributions, reinvesting them into dividend-growing stocks or real estate investment trusts compounds profits over time. This strategy harnesses the power of compounding, transforming modest dividends into a considerable revenue stream that develops independently of working hours.

Utilizing Delegation to Increase Revenue

The top performers recognize that delegation is not merely a luxury but a mechanism for profit. Assigning routine tasks—such as portfolio oversight and administrative duties—to dedicated teams liberates time for pursuing high-impact opportunities, such as negotiating private contracts or establishing strategic alliances. By concentrating on pivotal decisions, income increases while workloads decrease, severing the link between time and income.

Fluctuations in the market offer opportunities for passive income for those who plan strategically. Financial instruments such as structured notes or annuities linked to market performance can produce revenue without requiring active management, leveraging upward trends while reducing risks. These tools convert market changes into a revenue source that doesn’t depend on additional work hours.

Taking Equity in Scalable Enterprises

Exchanging time for a paycheck restricts earnings potential, whereas acquiring equity in scalable enterprises can lead to substantial returns. Wealthy individuals often invest in startups or growing companies for a percentage of the profits, rather than just a rise in value. As these businesses expand, dividend distributions or share buybacks yield income without daily involvement.

Structuring Income for Tax Efficiency

Inefficient tax burdens can be equated to reduced income—without the need for added effort. Enhancing investments through tax-advantaged accounts, capital loss harvesting, or financing in tax-exempt bonds retains more earnings. This deliberate structuring elevates net income by lessening deductions, providing a passive means to increase wealth quicker than any overtime.

Profiting more without extra hours relies on reorienting from income rooted in labor to revenue driven by assets and strategies. For those with insight, this involves valuing efficiency over mere effort, converting capital, expertise, and market understanding into flows that function autonomously. In the financial world, true achievement is not defined by longer working hours—but by creating a financial ecosystem that operates in your favor.

(Writer:Weink)