People Who Borrow Wisely Get Richer Easier

Borrowing is frequently viewed as a sign of fiscal weakness, but affluent individuals perceive it as an effective means to enhance their wealth. The distinction lies not between individuals who borrow and those who do not, but rather between those who borrow with a calculated approach and those who do so without consideration. For the financially secure, prudent borrowing is less about filling financial voids and more about capitalizing on opportunities, maximizing resources, and advancing beyond those who depend solely on their financial reserves.

Leading borrowers utilize debt to gain entry to valuable assets that are inaccessible to purchasers using only cash—such as private equity investments, off-market properties, or specialized business purchases. These prospects typically provide returns that significantly surpass interest expenses, fostering wealth accumulation at a faster pace than traditional saving methods. Unlike superficial borrowers, they do not pursue conventional investments; instead, they harness debt to engage with exclusive markets and assets that significantly compound value over time.

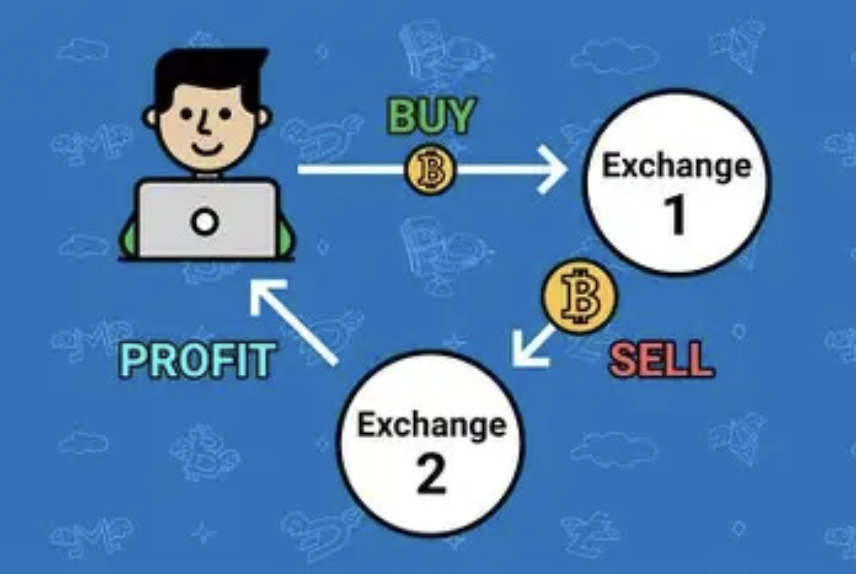

Time Advantage Through Thoughtful Borrowing

Smart borrowers recognize that time holds greater worth than mere financial resources. Rather than waiting for extended periods to gather money for a lucrative project, they opt to borrow in order to take action swiftly. This strategic time advantage allows them to seize early growth opportunities—whether in a startup's development phase or a property's value increase—while others are still waiting. By using debt, they accelerate their path to wealth, transforming anticipated profits into immediate assets.

Debt Arrangement as a Means of Tax Efficiency

Intelligent borrowers leverage debt to refine their tax strategies, a method that is frequently overlooked by casual lenders. They configure loans in a way that permits them to deduct interest repayments, counterbalance investment earnings, or postpone tax responsibilities related to asset transfers. This strategy is not about evading taxes but utilizing debt as a financial mechanism to preserve more capital for reinvestment. The advantages gained from astute tax management can significantly enhance wealth over time.

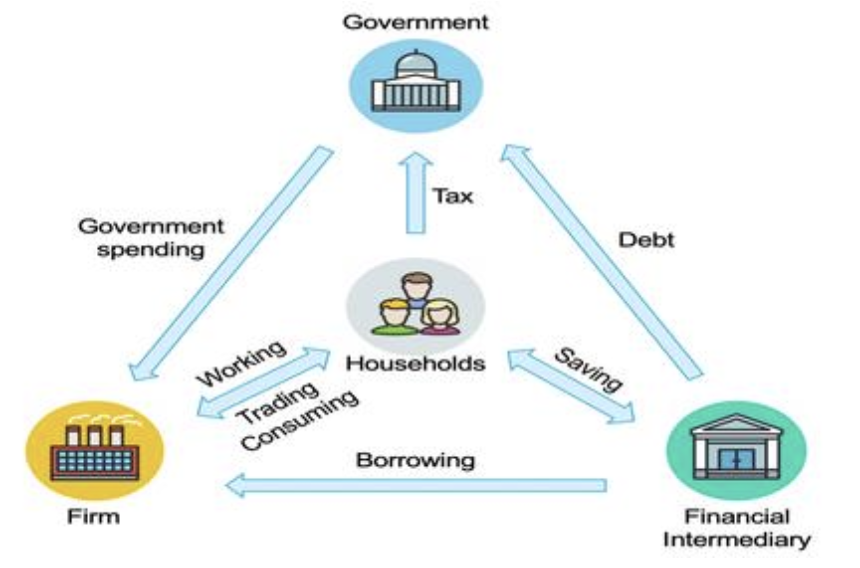

Employ Debt to Broaden Investment Risk

Against popular belief, intelligent borrowing mitigates risk through diversification. Rather than investing all personal resources into a single asset, they employ debt to distribute investments across various avenues—such as real estate, equities, and alternative investments. When one investment does not perform well, the others help to cushion potential losses, while cash flow from diverse sources manages debt repayments. This method transforms debt into a tool for risk management, rather than a burden.

Affluent borrowers employ debt as a means to connect with high-profile networks. Acquiring a significant loan from a prestigious financial institution often provides entry to exclusive advisory services, investment groups, and collaborative ventures. These connections yield knowledge and opportunities that outweigh the costs associated with debt, fostering a continuous cycle of wealth enhancement. In this context, debt serves as a gateway to influential circles that expedite success.

Mental Discipline: The Advantage of Borrowers

The most accomplished borrowers excel in emotional self-control. They refrain from borrowing based on market trends or personal pride and only take on debt for prospects that offer discernible cash flows or avenues for appreciation. They establish stringent repayment limits and steer clear of excessive borrowing, even during market peaks. This self-discipline transforms debt from a hazardous endeavor into a reliable strategy for generating wealth, distinguishing them from those who borrow indiscriminately and encounter failure.

(Writer:Ciki)