Spot Financial Scams: How to Stay Safe

For individuals with significant spending habits, financial fraud has evolved beyond basic tricks; such scams are now sophisticated, customized, and crafted to take advantage of your trust and desire for a particular lifestyle. Ranging from "exclusive" investment offers to bogus luxury asset transactions, con artists replicate authenticity to siphon off resources. The primary method of safeguarding yourself lies in enhancing your judgment rather than merely steering clear of obvious warning signs. It's about establishing a protective framework that transforms complex schemes into clear traps.

Question "Exclusive Access" Urgency

Fraudsters frequently employ "time-sensitive VIP entry" to force quick decision-making—consider phrases like "just 3 places left in this pre-IPO luxury investment." Take a moment to validate: Genuine exclusive offers never require instantaneous commitments. Contact the organization's official representative (not the contact information given by the fraudster) to affirm the opportunity. For instance, if a "private bank advisor" proposes a unique art investment, call the bank’s main number to verify the advisor’s existence and the validity of the deal. Pressure tactics are meant to circumvent your analytical thinking—don't allow that to occur.

Decode "Obscure Language" Concealment

Frauds frequently disguise themselves behind convoluted terminology: "quantum AI asset management," "blockchain-supported luxury derivatives." If an offer cannot be articulated in straightforward terms, this should serve as a warning. Request the person making the presentation to explain the strategy clearly, detailing how profits will be achieved. Reputable advisors appreciate transparency; fraudsters utilize complex language to discourage you from asking questions. If it appears too convoluted to grasp, it is too perilous to invest in.

Numerous scams include fictitious assets: imitation luxury watches, nonexistent real estate, or bogus investment portfolios. Insist on undeniable proof of ownership: For property, ask for official land registration documents containing a verifiable reference number. For artwork or collectibles, request authentication certificates from well-respected third-party specialists (not from the fraudster's purported "expert"). Authentic assets possess distinct, traceable ownership records; scams depend on indistinct or falsified documentation.

Establish "Dual Approval" Guidelines

Create a personal guideline: No financial decision exceeding a certain amount (for instance, $50,000) is finalized without a second opinion from an independent authority—this could be your attorney, a reliable financial consultant, or a family member who is not involved in the transaction. Scammers aim to isolate you to evade scrutiny; a second perspective can highlight oversights you may have overlooked. Even when you feel certain, this additional tier provides a safety net against temporary errors in judgment.

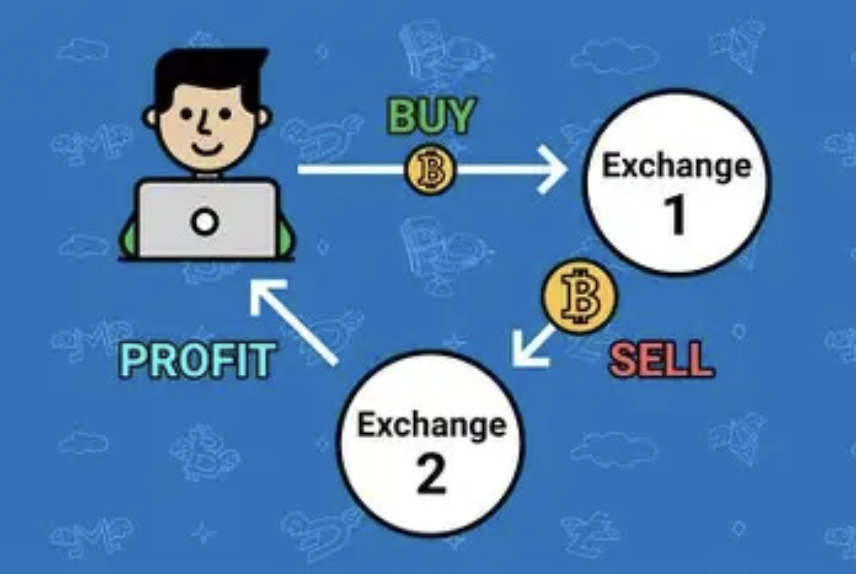

Watch for "Suspicious Payment" Indicators

Fraudsters often push for payments that are difficult to trace: cryptocurrencies, gift cards, or wire transfers into personal bank accounts. Reputable organizations will use accounts that bear the company name. If you are requested to make payments using unconventional methods or directed to a "private account for tax purposes," it is wise to walk away. Additionally, be cautious of "advance fees"—fraudsters often require payment up front for "administration" or "access," only to vanish afterwards. Genuine opportunities will deduct fees from the profits, not beforehand.

Financial scams succeed by transforming falsehoods into opportunities that seem tailored to you. By challenging urgency, verifying social proof, deciphering jargon, authenticating assets, employing dual approval, and examining payment methods, you create a solid defense. It is not a matter of being skeptical—it is about being prudent. For individuals with high spending patterns, safeguarding assets entails remaining watchful while ensuring that fear does not impair your capacity to identify genuine opportunities. By using these tactics, you can detect scams before they can find you.

(Writer:Laurro)