Avoid Retirement Crises: Key Planning Steps

Retirement ought to be a period of liberation rather than financial anxiety. Individuals with high consumption habits must adopt proactive, tailored approaches to prevent retirement challenges, seeking methods that exceed fundamental saving techniques—prioritizing risk management, asset integration, and sustainable lifestyles.

Rather than merely assessing returns, envision potential worst-case situations: a market crash, sustained inflation, or unforeseen healthcare expenses. Utilize resources that can illustrate how your portfolio might react if the market declines by 30% or if inflation escalates to 8%. Wealthy investors may need to decrease their investment in high-risk tech stocks and incorporate assets that resist inflation, such as infrastructure funds or ETFs linked to gold.

Lock in "Essential Income" Before Retirement

Ensure that unavoidable expenses (such as housing, healthcare, and essential luxuries) are covered by reliable income sources. Merge your Social Security benefits (delayed to enhance monthly payments) with fixed indexed annuities or immediate annuities. Establishing this "income floor" means you can avoid dipping into growth assets during market declines, thereby safeguarding wealth for discretionary activities like vacations or hobbies.

Address "Hidden Liabilities" Head-On

Identify and tackle lurking risks: unresolved business debts, co-signed loans, or insufficiently insured properties. For instance, if you have co-signed a loan for a child’s venture, pay it off or renegotiate the terms prior to retirement. Uninsured luxury items (like art or yachts) could significantly impact your finances if damaged—ensure policies reflect their full replacement value to prevent unexpected costs.

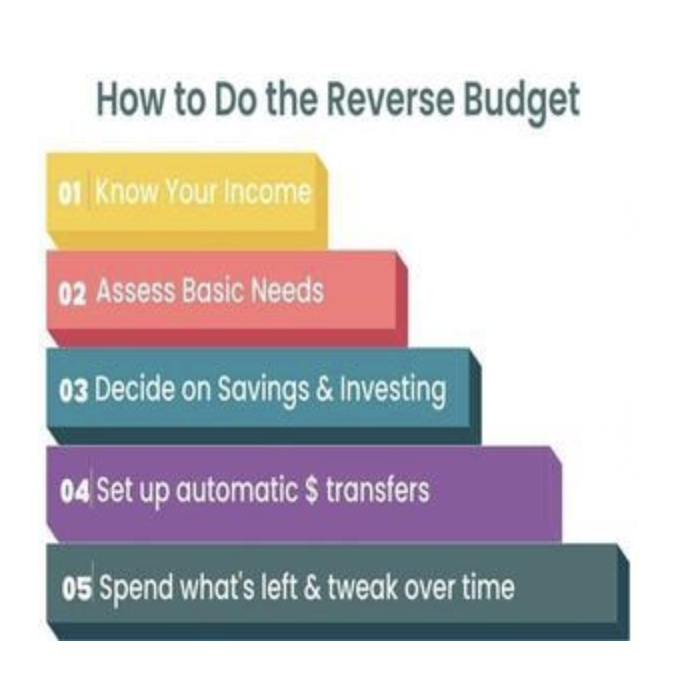

Adopt a "Reverse Budgeting" Mindset

Rather than budgeting according to income, initiate planning with your desired retirement expenditures in mind. Estimate yearly expenses for your ideal lifestyle (for example, $200,000 annually for high-end travel and exclusive clubs) and work backward to ascertain the capital needed. This approach uncovers deficits early—if you find yourself lacking, consider increasing contributions to tax-advantaged accounts or altering asset allocation to enhance growth potential.

For example, if your objective is to stop working at 65 with yearly costs of $200,000 and you follow the 4% guideline (a frequently used guideline for retirement withdrawals), your savings should total $5 million. If your current age is 40 and you have $500,000 set aside, you can figure out how much you need to contribute each year—taking into account a 7% typical annual return—to close the deficit, making changes like increasing your 401(k) contributions or including a Roth IRA if you haven't done so yet.

Create a "Flexible Withdrawal" Framework

Steer clear of the 4% withdrawal guideline—implement a variable withdrawal strategy instead. During prosperous market years, withdraw 5-6% for discretionary expenses; in less favorable years, reduce withdrawals to 3% and depend on assured income. Combine this with tax-loss harvesting (selling underperforming assets to balance gains) to lessen tax burdens, thereby retaining more funds in your possession.

Plan for "Longevity Risk" with Health Investments

Invest in preventive healthcare and assets focused on longevity. A premium wellness membership (featuring customized care) can decrease future healthcare expenses. Furthermore, designate 5-10% of your portfolio to biotechnology or healthcare innovation funds—these sectors may flourish as medical progress extends lifespans, helping finance longer retirement periods.

In summary, steering clear of retirement crises requires vision, not mere chance. By rigorously stress-testing portfolios, securing essential income, and preparing for longevity, individuals with significant wealth can ensure their retirement is characterized by independence and devoid of financial trepidation—relishing the rewards of their efforts without compromise.

(Writer:Weink)