A Close Study of Capital Allocation

Those successful companies not only have good performance, but also have a reasonable capital allocation, which can help maximize the interests of shareholders. Capital allocation is one of the most important responsibilities of corporate management, because it determines the company's prospects. But unfortunately this is often overlooked. This article will discuss how to assess a company's capital allocation capabilities under various market conditions.

Every company follows a certain life cycle. In the initial stage, capital allocation is very simple, at which point most of the cash flow will be reinvested into the growing business, so there won't be much left over. After years of strong, steady revenue growth, the company comes to realize that there is less and less market space to exploit. In other words, developing new products or increasing production yields only half as much profit as in the early days. In the end, the company will enter another stage with sufficient cash and additional funds, at which point the company can allocate capital in the following ways:

Enter other industries: This requires more start-up capital, but the long-term benefits are best.

Improve core business capabilities: This approach works well before growth rates start to decline.

Distribute or increase dividends: That is tried and true.

Paying Down Debt: This approach increases financial efficiency and continually reduces financing costs.

Invest in or acquire other companies: Use it carefully and always around the company's core competencies.

Repurchase company stock.

Before the final decision, the management will also refer to some indicators which investors pay attention to, such as:

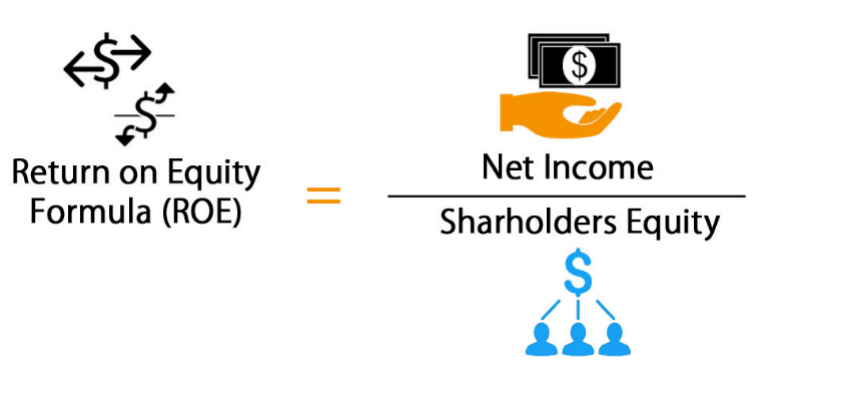

Return On Equity

A stock's Return on Equity (ROE) reflects the growth rate of a company's "shareholders' equity." When researching a company's ROE, there are a number of factors to consider, including the company's history as well as the type of business. Young companies have a higher ROE because capital allocation is not that hard for them. Older companies and capital-intensive companies have a lower ROE because they require more up-front investment to get their first income. The capital needs of each industry are different, so is the ROE. We can only compare ROE in the same industry. If a company's ROE is higher than the industry average, it means that the company's capital is more fully utilized.

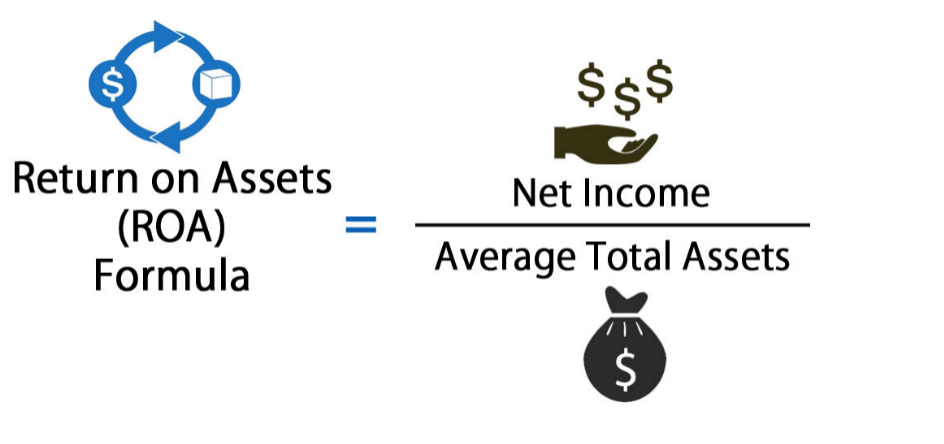

Return On Assets

Return on Assets (ROA) is similar to ROE, except that the denominator of the equation is changed from shareholders' equity to total assets. ROA shows how much income management has made with disposable assets. It varies widely across industries, so comparisons can only be made within the industry. In the long run, ROA provides a clearer picture of a company's profitability than ROE. In fact, while a company's ROE varies from year to year, its ROA does not vary a lot.

Capital Requirements and Cash Management

Assume that the average ROE in the first ten years after Company A is established is 18%, indicating that the company is growing rapidly, but this is achieved on the premise that the company has huge room for development. When Company A has gained the majority of the market share, it has foreseen that it will not be able to sustain this growth rate and therefore must increase shareholder value through other means. While the capital required to sustain the business is obvious, the company still needs to assess the durability and continuity of free cash flow before deciding on the best use of the funds based on one or more of the methods mentioned above.

Dividend

Stocks are attractive to many investors, not only because it returns free cash flow to shareholders, but also attracts long-term investments. The lower the payout ratio, the more room for management to increase the payout ratio in the future. The most established dividend-paying companies pay shareholders 80% or more of their net earnings. Although this can improve the yield of the stock, it may also lead to insufficient funds for the company's future development, so the stock of a company with a high dividend payout has less room for appreciation.

Stock buybacks are also a common capital allocation method. If the company believes its stock is undervalued, it will aggressively buy back its shares to make the most of the capital, which increases the percentages of all other shareholders. Therefore, if the company has a buyback of shares, it shows that the management is optimistic about the company's prospects.

(Writer:Zhada)