How To Reducing The Cost of Car Insurance

How To Reducing The Cost of Car Insurance

People pay different amounts for car insurance because of factors, including where they reside, which insurance provider they go with, and what coverage they need. In order to cut costs on auto insurance, it helps to know the national average premium.

The cost of car insurance is something that may be reduced in a number of ways. After calculating your auto insurance costs, you can use any of these methods.

1. Benefit from buying car insurance of more than one car

Auto insurance quotes for a single vehicle may be more expensive than quotes for multiple vehicles together. A flat rate plan is what the insurance provider will offer if they decide to insure your firm. They might offer you a better price if you promise to give them more money.

See if you qualify by having your rep look into it. Theoretically, all of the drivers in a carpool must be related in some way. The car must be owned jointly by at least two people who are not relatives.

In general, having a driver younger than 25 on your policy will increase your premium.

It's worth remembering that if you currently have their family insurance, you may be eligible for a discount if you buy further plans from them.

2.Be aware of the current road conditions

Safety calls for extra caution behind the wheel. Despite the fact that it goes without saying, with the recent uptick in distracted driving, it is worth emphasising. More accidents and violations may be avoided if drivers pay closer attention to the road. Safe driving might reduce your insurance premiums by as much as 23% based on your driving habits.

Most drivers are unaware that traffic offences result in points for the driver and that the more points a driver has, the higher their insurance premiums would be.

3. Sign up for a course in defensive driving

Customers who take and pass a defensive driving course may be eligible for insurance premium discounts. Various driving courses are available to help drivers lessen their licence points, including defensive driving, collision avoidance, and others.

Before enrolling in a course, you should contact your insurance provider to find out whether you are eligible for any discounts. The insurance savings from taking the course should justify the time and money spent on it. Drivers also need to take and pass a certified training programme. Locating the legally mandated defensive driving programmes in your area is as simple as doing an internet search. You can research online which defensive driving programmes are accepted in your area.

4. Comparing policies from multiple companies

If the cost of your annual premiums has gone up dramatically since you renewed your coverage, you may want to shop around for a different provider. Additionally, it is prudent to compare insurance quotes every few years to see if cheaper alternatives are available.

Working with the cheapest provider isn't always the best option, so keep in mind that "cheap" doesn't always mean "excellent" because you also need to think about the insurance company's financial stability. After all, an insurance policy is useless if the insurer cannot afford to pay a claim.

Reviewing an insurance provider's financial stability is as simple as looking up their rating online. Make sure you understand what your insurance policy covers in addition to the company's financial stability.

If you want to save money on auto insurance, it's a good idea to find out the company's policy on annual mileage.

5. Ride the bus/train more

To apply for health insurance, a questionnaire is typically required. It is common to practise for insurance companies to inquire about annual mileage driven by policyholders.

The premium for a daily commute of two hours is often higher than the premium for a daily commute of one kilometre. Use public transportation options, but keep in mind that lowering your annual mileage may be required to qualify for certain discounts. In order to avoid wasting time, it's a good idea to find out from your insurance provider the specific mileage restrictions that apply to your coverage.

You should also contact your insurance company to see if they have any discounts available for drivers with low annual mileage.

6. Go with a Less Heavy Vehicle

An expensive sport utility vehicle that costs £5,000 can seem like a good idea, but it could cost you more insurance premiums than a more mundane but secure commuter car. Some insurance firms might offer price reductions to policyholders whose automobiles are hybrids or run on alternative fuels.

You may reduce your insurance premiums and do your part to safeguard the planet at the same time. It would help if you researched the insurance premiums for the vehicles you're considering purchasing before making a final decision.

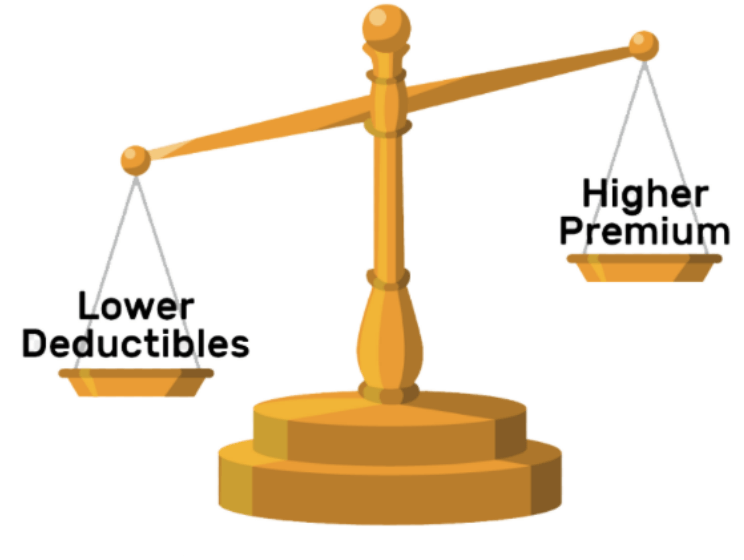

7. Raise your deductible

Your deductible is the amount you will be responsible for paying out of pocket if you are involved in an accident or another covered event that causes damage to your car. Depending on the policy, deductibles might range from $250 to $1,000.

However, the larger the deductible is, the lower the premium is. Inquire with your insurance agent about the possibility of a decrease in rates resulting from an increase in your deductible. It could save you money each year on your premium or have no effect. Instead of reducing your claim amount in order to keep your premiums from rising, you may want to consider raising your deductible.

8. Raise your credit rating

Insurers use a driver's history and actions to determine their premiums. An insurance provider may find it expensive to cover drivers who have been in many accidents. People are often taken aback to learn that their credit score can affect their insurance prices.

Insurance companies frequently use credit-based insurance ratings. Insurance claims studies demonstrate that people who take responsibility for their own lives are less likely to file insurance claims, a controversial matter in several regions.

Maintaining a high credit score is important regardless of this fact.

(Writer:Hawag)