Why Should You Invest Just Like this?

Savings

Saving, or savings, is an investment behavior welcomed by ordinary households, and is also the most commonly used investment method. Compared with other investment methods, savings is safe and reliable (protected by the Constitution), convenient in procedures (savings outlets are all over the country), flexible in form, and inheritable. Savings is a kind of business for banks to mobilize and absorb the surplus monetary capital of residents in the form of credit. After absorbing savings deposits, banks will put the money into the social production process in various ways and make profits.

Investing in Gold

Gold investment has always been a hot spot in the personal finance market, attracting the attention and favor of investors. Especially in the past two years, the international gold price has continued to rise. It can be predicted that with the gradual opening of the domestic gold investment field, the growth potential of gold demand in the future is huge.

TB

At present, there are many varieties in the national debt market, and investors have many choices. New attempts and reforms have also been made to the issuance of national debt, further improving the marketization level of national debt issuance, so as to minimize the interference of non-marketization factors. It can be seen that this series of innovations in national debt will surely bring investors more investment options and greater profit margins.

Bond

The boom in the bond market was unexpected. All kinds of signs indicate that the issuance of corporate bonds is likely to speed up, and corporate convertible bonds, floating rate bonds, bank subordinated bonds, etc. will become good investment products for people.

Foreign Exchange

With the continuous decline of the US dollar exchange rate, more and more people have gained a lot of profits through personal foreign exchange trading, which also made the foreign exchange market once extremely hot. A variety of foreign exchange financing products have also been introduced.

Insurance

Compared with the tepid insurance market, the income type of insurance has been highly sought after once it was introduced. Generally, there are many types of income insurance. It not only has the most basic insurance protection function, but also can bring investors a lot of income, which can be described as a win-win situation for security and investment. Therefore, the purchase of income insurance is expected to become a new investment and financial hot spot for individuals.

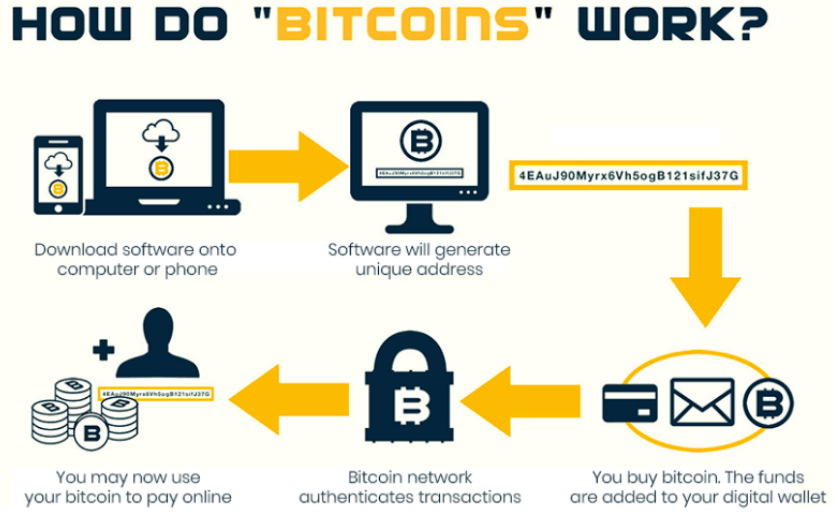

P2P

"P2P", namely "individual to individual", is a new generation of private lending form closely related to Internet, microfinance and other innovative technologies and innovative financial models. It maximizes the possibility of transparent, open, direct and safe micro credit transactions for familiar or unfamiliar individuals. It is young, innovative, cautious and low-key.

Conclusion

Through these methods, you will realize that investment and financing are not difficult. If you can understand, master and implement the sails above, you can seize the wind of investment and financing, get rich quickly and achieve the goal of wealth freedom.

(Writer:Matti)