Without Financial Numbers, You Misunderstand Life

For high-net-worth individuals, financial numbers are often reduced to tools for wealth management or investment decisions. Yet beyond portfolios and profit margins, these numbers are the invisible language that decodes life’s most critical realities—from personal well-being to long-term security and even lifestyle choices. Ignoring or misunderstanding financial numbers doesn’t just risk wealth erosion; it leaves one disconnected from the true costs, trade-offs, and opportunities that shape daily life and future aspirations. Below are the underdiscussed ways financial numbers illuminate life’s essential truths.

Financial Numbers Reveal Lifestyle Sustainability

Wealthy lifestyles—expensive residences, exclusive travel experiences, high-end activities—are frequently enjoyed without analyzing the financial details that support their viability. Financial indicators such as fixed versus discretionary spending ratios or lifestyle inflation metrics provide a more comprehensive picture than income figures alone. For instance, an increasing share of income allocated to essential luxury expenses indicates a precarious lifestyle that may falter during economic downturns. Grasping these financial figures prevents confusion between short-lived wealth and lasting stability.

They Reveal Undiscovered Opportunity Costs

Every decision in life carries an opportunity cost, and financial figures bring these choices into perspective. A wealthy individual may not realize how the financial implications of owning a second home—mortgage interest, upkeep, property taxes—redirect resources away from retirement funds or charitable aspirations. Financial data convert abstract choices into tangible realities, aiding in decisions that reflect core principles instead of spontaneous wants.

Freedom—whether it involves early retirement, flexible work options, or creating a legacy—is not just a vague hope; it is a goal determined by financial figures. Metrics such as saving rates, levels of passive income, and retirement needs adjusted for longevity indicate how near one is to genuine freedom. Misinterpreting these figures can lead to misplaced confidence in future security, whereas accurately understanding them facilitates proactive measures to prevent exhausting financial resources or losing independence.

They Indicate Health and Well-Being Trade-Offs

Few individuals connect financial figures to their physical and mental health, but expenses such as healthcare inflation, gaps in insurance coverage, and the financial consequences of stress-related work absences tell a significant narrative. For instance, underestimating long-term healthcare expense forecasts can disrupt retirement plans, while evaluating the financial benefits of health-focused investments (like fitness programs or preventive services) underscores their worth beyond just health improvements.

In both personal and business relationships, financial figures uncover unspoken priorities and power dynamics. Spending trends in joint accounts, budget allocations for gifts, or profit-sharing arrangements in business partnerships reflect shared (or conflicting) values. Misinterpreting these figures may lead to disappointment or resentment, while understanding them promotes openness and trust in relationships that are most vital.

They Clarify Philanthropic Impact

For wealthy individuals who are passionate about giving, financial figures are essential for assessing genuine impact. Beyond just the amounts donated, metrics such as the overhead ratios of charities or social return on investment (SROI) demonstrate whether contributions lead to substantial change. Misunderstanding these figures could result in misallocation of resources to ineffective causes, while using them wisely guarantees that philanthropic efforts yield meaningful and enduring benefits.

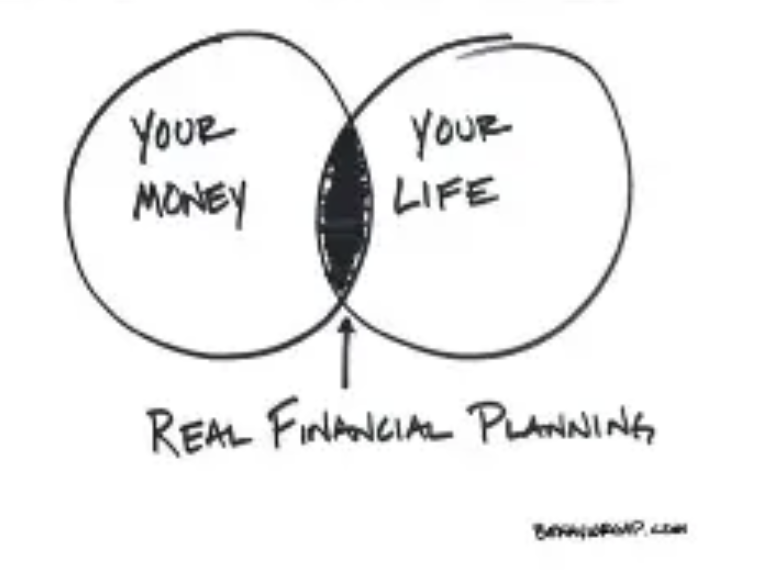

Financial figures encompass more than just monetary considerations—they serve as a perspective through which we comprehend life’s fundamental framework. For affluent individuals, becoming proficient in this language is not merely a financial obligation but a crucial step to recognizing life’s costs, opportunities, and potential. Disregarding financial data is akin to traversing life with limited vision, overlooking the cues that facilitate informed and intentional living.

(Writer:Frid)